$100B walks out the door

What we learn about recruiting and retention from analyzing 150M+ job change events

Live Data analyzed over 150,000,000 job change events (see the notes on methodology1).

There are seemingly infinite ways to slice and analyze this data. But, so as not to bury the lead, this analysis immediately uncovered a $100B problem.

This edition of the Human Capitalist is the first pass (of many) at asking questions about job change data, tenure, and their consequences. The first questions are:

a) How long do people stay at a company before leaving?

b) What can this tell us about the health of recruiting and retention?

Dive into a $100B problem below. Plus, as always, get the highlight reel of the latest human capital insights by reading to the bottom for the three quick hits and the opportunity to submit your own human capital questions.

“I quit!” + “You’re fired!” = $100B+ per year

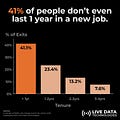

From our sample, over 41% of people who changed companies did so within 12 months of starting a new role. This means that one can reasonably conclude that 41% of job changes failed, costing employers over $100B per year.

That’s right: $100B+ of waste — every year.

How can such an important decision go wrong so often, and how might the process be improved? Before we address these questions let’s dig into data.

So, how to explain this data?

While there are surely examples of short-term employment situations in the data (internships, contract work, etc.), the vast majority of the positions reflect situations that both the employer and the employee would expect to lead to long-term employment.

To say that almost half of the people who left did so before they reached their one-year anniversary can only be considered a failure on both sides.

And, while difficult to measure the cost of this waste precisely, we can look at other information to come up with a reasonable estimate of the ghastly waste associated with a broken hiring process.

+ Recruiting Costs: $20B ($2,500 per new hire; 50% of the white-collar average)

+ Onboarding & Training: $40B (40% of the almost $100B spent on new hire training annually)

+ Turnover Costs: $40B ($5,000 per departure; 33% of the national average)

= Over $100B annually

So, even with our conservative, discounted estimates, the waste associated with failed hiring decisions easily approaches $100B annually. All before we even consider wages, benefits, and other human capital-related OpEx.

Simply, the hiring process is broken and the problem is massive.

Can hiring and retention be fixed?

With the understanding that products and services that improve hiring and retention are part of a market that is worth “billions with a B” if not “trillions with a T”, there are a handful of immediate questions to ask.

Who is going to tackle this problem?

A quick search reveals hundreds of hiring and recruiting platforms, thousands of agencies, and millions of professionals who are trying to solve for hiring.

Who, or what, will create a paradigm shift in how both sides go about the employee-employer match-making process?

How can AI fix hiring and retention?

With a human-led hiring process that leads to such a high rate of failure, can AI (or at least humans with better AI tools) improve hiring and retention?

How are the companies that are building the next gen of AI recruiting solutions training their models and recommendation engines? Given the current turnover rate, it is clear that the existing solutions that match resume data to job posting data aren’t succeeding.

Can training AI recruiting software on job change data unlock deeper insights into which candidates are more likely to turnover, in which roles, and at which companies?

What do you want to know about tenure?

As mentioned in the intro, this edition of Human Capitalist is the first of many deep dives into the data on 150M+ job change events from the last five years.

Since there are many ways to slice this much data, I want to know what insights are most interesting to you and what I should dig into next. Vote below 👇

Three quick hits

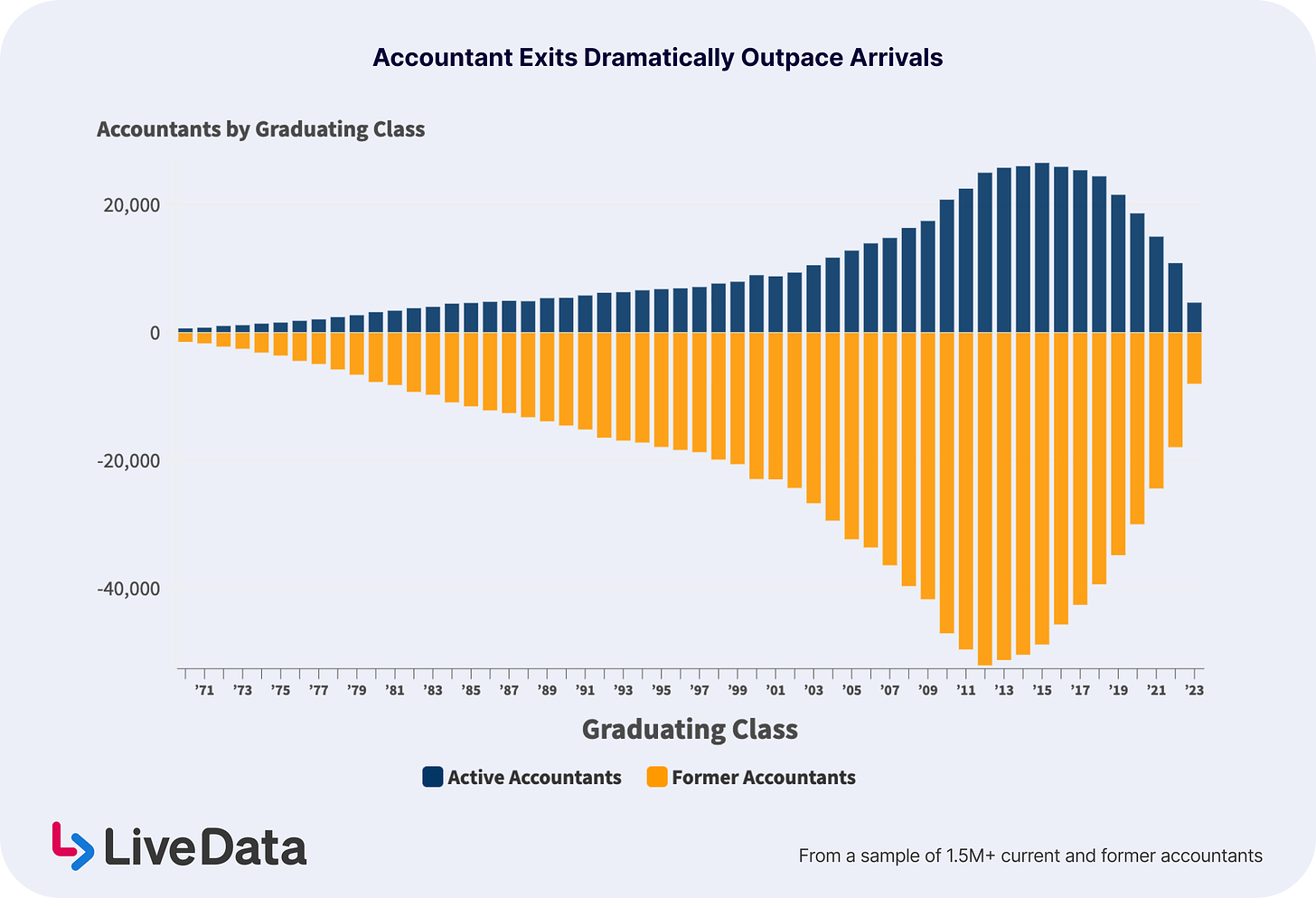

1) What is the future of accounting?

Hundreds of thousands of accountants have left the profession in recent years. An increasing percentage of exits are accountants who are later in their careers.

We provided real-time job change data to The Wall Street Journal to report on the trends in accountant tenure and arrivals/departures from the profession.

Read more about the accountant shortage here.

2) Will there be as many SDRs and BDRs in the future?

From 2015 to late 2022, the number of active SDRs and BDRs increased by over 280%. In Q3 2023, year-over-year SDR and BDR role growth has been 5%, less than a fifth of the 28% year-over-year growth in Q3 2022.

Understand the trends for entry-level sales jobs here.

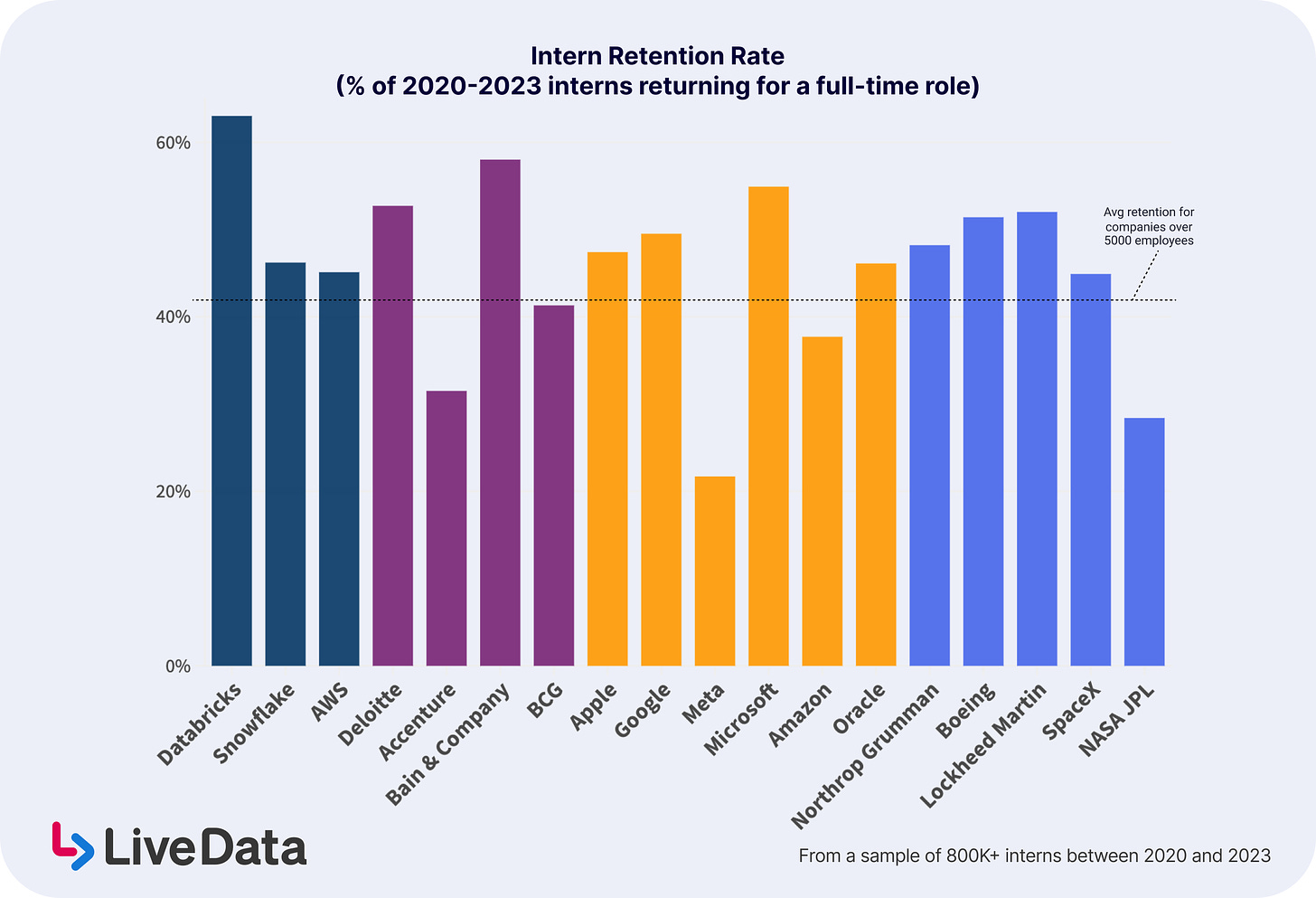

3) Where do all the interns go?

Hundreds of thousands of students and early-career individuals work an internship every summer. How many of them return to the company full-time?

Read more about intern retention rates here.

What questions would you ask?

To put context around the “big numbers” of real-time human capital and job change data — specifically, 30k+ daily changes across 90M+ people at 4M+ companies — I started asking questions of our data.

For every question, there are answers, insights, and… more questions.

I’m constantly thinking about the next batch of questions and insights to dig into. If there is a human capital data question you’re interested in exploring, leave a comment below or reach out directly via LinkedIn.

*Notes on methodology

A few notes on the sample of 150,000,000+ job change events.

A job change event includes a title change, promotion, or company change. This includes people who leave a company and do not join another company.

An individual who changed jobs more than once during our sample period can be mapped to more than one job change event.

People who started a job before the sample period but changed jobs during the sample period are included.

The graphs below only include data on people who changed jobs during this period — someone who stayed in a given role for the entirety of the sample period is not included.

The sample of 150M+ job change events had 95M+ company changes and 55M+ internal job changes.

The sample of people is taken from Live Data’s database of 90M+ individuals. Each person has meaningful and verifiable digital exhaust regarding their employment status and work history. Thus, the vast majority of this cohort is part of the white-collar workforce.