People Movement = Economic Movement

Human capitalist starts with two relatively simple premises:

People are the driving force behind the economy

Employment is the driving force behind people’s economic decisions

Employment drives economic decisions from a $4 cup of coffee bought on the way to the office to a $40,000 SaaS subscription to a $4,000,000 office lease, all the way up to a $40,000,000 change in city tax revenue.

Everyone from governments to corporations to investors has spent decades trying to measure and predict human capital flows and employment data for a seemingly endless number of use cases.

Now, real-time job change data unlock actionable insights into the movement of humans and capital at the individual level, the company level, the industry level, and beyond.

To put context around the “big numbers” of real-time job change data

— specifically, 30k+ daily changes across 90M+ people at 4M+ companies — I started asking questions of our data.

For every question, there are answers, insights, and… more questions. Keep reading for a highlight reel of the latest human capital insights, including:

The Great Termination: How are laid-off professionals faring in H2 2023?

Three Quick Hits: Highlights of the latest human capital insights.

How is the modern revenue team changing?

Is 2023 the end of new podcasts?

Is everyone a VC now?

A Deep Dive into OpenAI: Examine the human capital flow at the company driving a wholesale disruption that’s just getting underway. Who works for OpenAI? Where’d they come from? And what exciting companies are they going to when they leave?

Plus, read to the bottom to submit your own human capital questions.

The Harsh Reality of Professional Layoffs

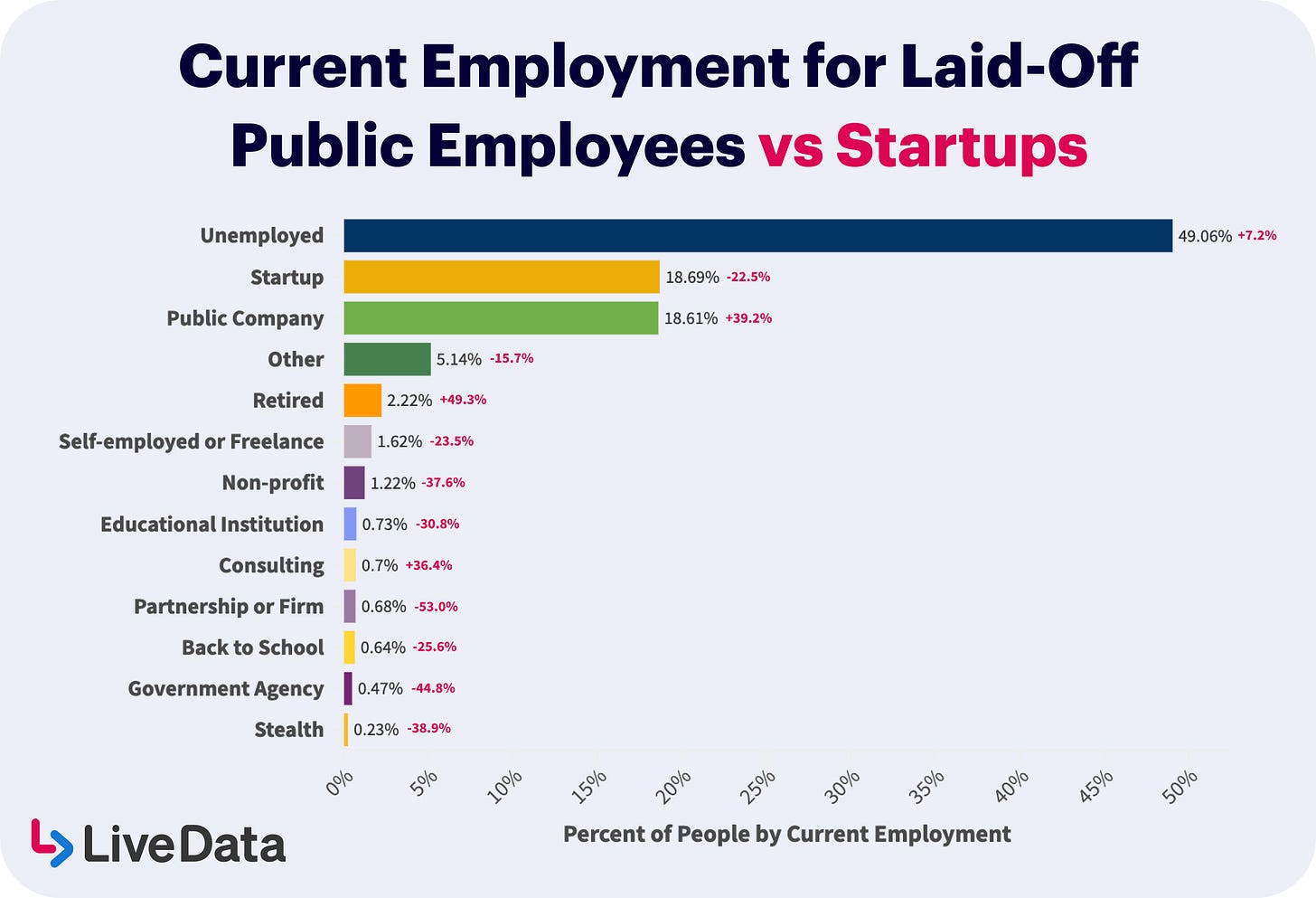

Across the universe of 90M+ professionals monitored by Live Data, 500k+ people have been laid off or unemployed within the last three quarters. I sampled 55,000+ laid-off startup employees and 105,000+ employees laid off from a public company during this period.

From the sample of hundreds of thousands of professionals (those who were working a white-collar job) laid off in the last three quarters, almost half are still professionally unemployed.

This number seemingly flies in the face of the current 20-month low in jobless claims or the 209,000 jobs that were added in June. But, this discrepancy tells us a lot about the jobs that former “white-collar” workers are finding.

To the government entities that track labor and employment, “a job is a job”. Many of the people that were let go from their white-collar roles are working non-professional jobs as they continue their job search. Put differently, these people are likely working jobs to make ends meet rather than professional jobs that match their previous experience.

Startups vs public companies: Who fares better after a layoff?

The most thought-provoking differences between the (re)employment outcomes for laid-off startup employees and laid-off public company employees:

A greater percentage (7.2% relative difference) of public company employees remain unemployed or underemployed.

While startup employees were 1.8x more likely to join another startup, public employees are equally likely to choose a startup or another public company.

Startup employees are ~1.4x more likely to start a freelance role OR go back to school OR start at stealth versus public company employees.

1.37x more public company employees go into consulting. Who better to sell high-value consulting engagements to a public company than people familiar with public companies?

Looking at the (re)employment outcomes for employees coming from a startup vs a public company, startup employees are no worse off when laid off and job hunting. Unsurprisingly, startup employees seem to be “scrappier” and more likely to take bets when finding or creating their next job.

Peter Walker’s post that “Startup hiring isn’t keeping pace” sparked this whole deep dive into the (re)employment trends of laid-off professionals. But… more generally, white-collar hiring isn’t keeping pace.

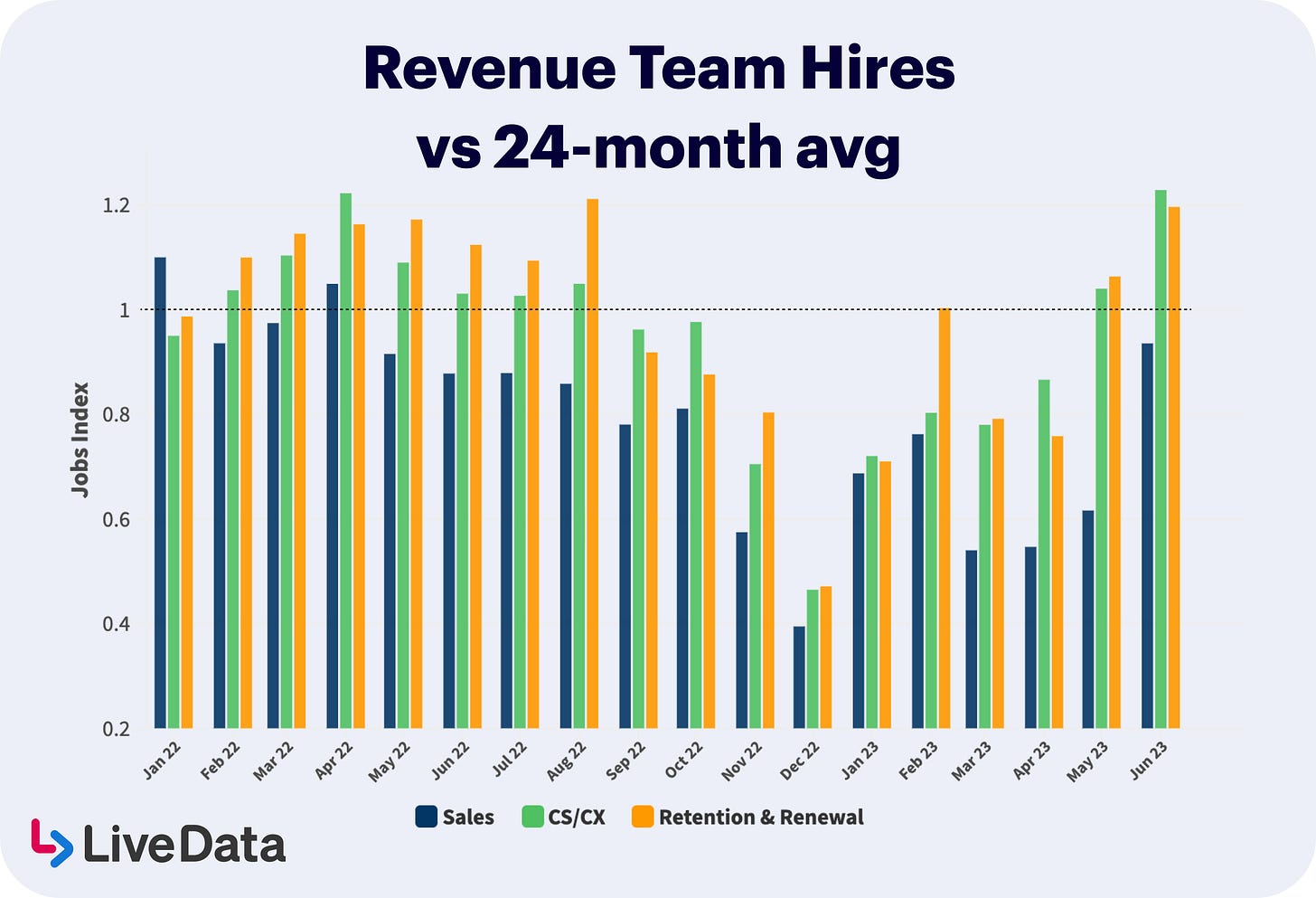

Are revenue teams restructuring to focus on retention?

The revenue team is changing. Hiring for sales roles remains 7% below pre-2022 levels. Hiring for CS/CX and retention roles is 20% above pre-2022 levels.

Read more about how and why the makeup of revenue teams is changing.

Are there too many podcasters? 🎙️

Over the last 5 years, seemingly everyone and every company started a podcast. The number of active professional podcasters grew ~2.6x from 2018 to 2020 and more than doubled again from 2020 to 2022. The monthly average for new podcasters in the first half of 2023 was less than half of the previous two-year average.

Why are there fewer new podcasters in 2023? Read more about the people behind your favorite shows.

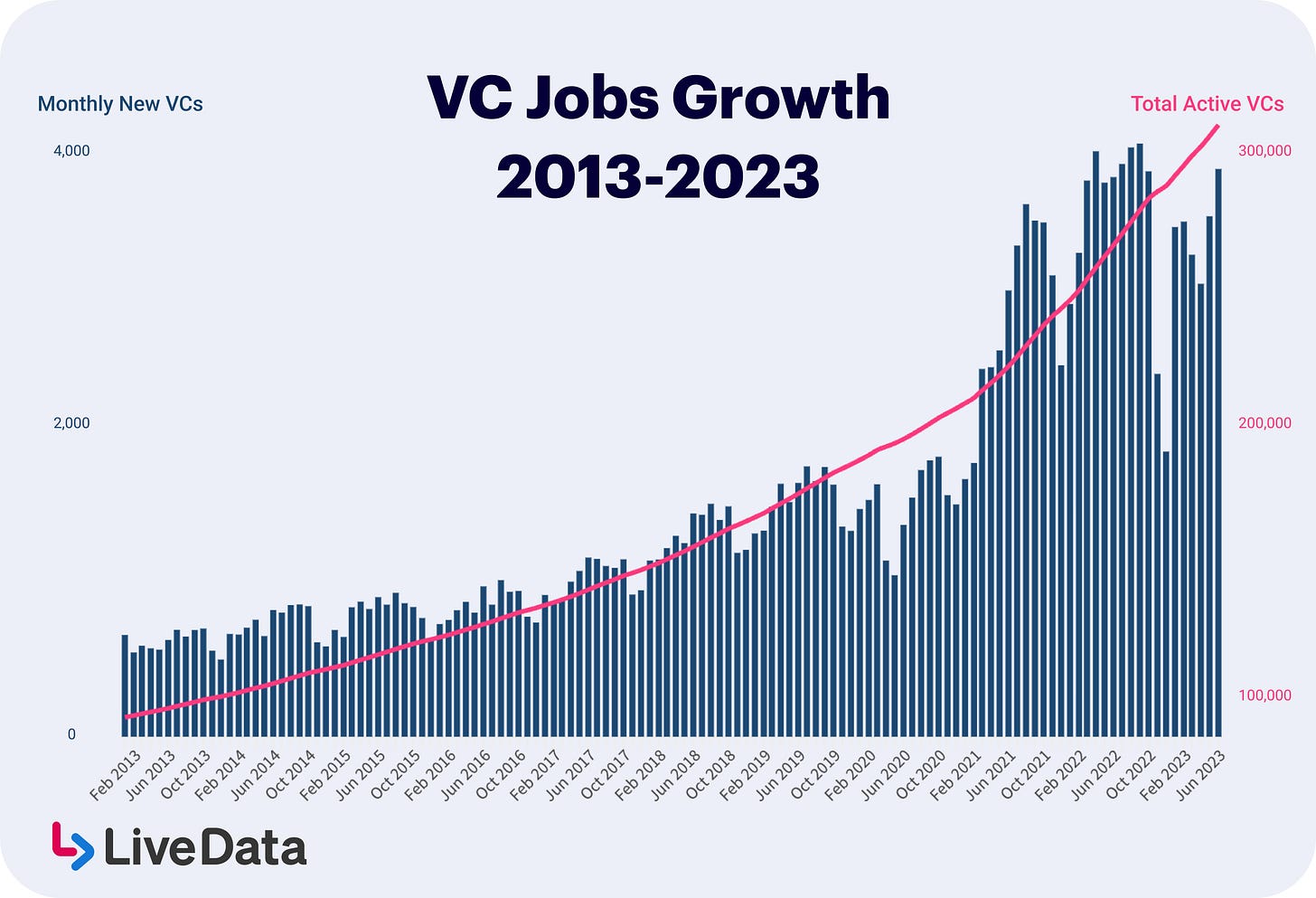

Are VC firms on the same trajectory as their portfolio companies?

In 2023, there are more than double the number of active VCs than in 2013.

There're too many funds, too much capital, and too many staff to support an industry that thrives on the effective deployment of capital. Many VC firms are on the precipice of facing the same rightsizing pains brought on by the same return to rigor and tighter economic conditions as their portfolio companies.

Read more about the massive growth (and likely rightsizing) of the VC industry.

Exploring the Human Capital at OpenAI

OpenAI is in the driver’s seat for the AI revolution. With GPT-5 on the horizon, explore the charts below to see the people behind the company disrupting generative AI.

6-Month Growth: +50%

$11.3B in funding fuels massive growth. Record-setting user adoption and rapid innovation both require greater investments in human capital to keep pace.

Unsurprisingly, the dramatic growth comes almost entirely from engineering and technical staff.

The most anomalous functional expertise increase is the early 2023 investment in risk, safety, and compliance staff.

A wave of engineering talent left in March. Where did they go? (see Alumni section below)

What other surprising trends do you see at first glance? What would you want to know about the people that make up the bars?

Where are the OpenAI Alumni?

Over 50 OpenAI alumni have already started a new role at their next company. Roughly 10 former employees are currently in Stealth and another 20+ are likely in “super stealth” — at “None” and building the next big thing.

Beyond the people in stealth or “super stealth”, notable next steps for OpenAI alumni include other AI disruptors, Anthropic and Character.AI, as well as many who have been lured to (or back to) Google or DeepMind.

For all of the current OpenAI talent that came from established Big Tech companies, what prior experiences made them the best candidates for a company that can realistically hire “almost anyone they want”?

Explore the human capital at any company via our company directory.

What questions would you ask?

I’m constantly thinking about the next batch of questions and insights to dig into. If there is a human capital data question you’re interested in exploring, leave a comment below or reach out directly via LinkedIn.