Musical Chairs: A Shrinking SaaS TAM

What happens to SaaS markets when licensable seats disappear?

“Within the next 24 months, 2 out of 3 current SaaS startups will likely be forced to shut down.”

– Santosh Sharan, COO at Retention.com

The future Santosh sees seems shocking given were coming off 10+ years in which the SaaS industry grew at astonishing rates. Thousands of companies hired aggressively and seemingly everyone, on every team, needed every tool in the toolbox. SaaS company growth was the rising tide that lifted all boats.

For companies with seat-based or user-based pricing models, continued headcount growth turned their TAM into an all-you-can-eat buffet.

Fast forward to the end of the ZIRP era in late 2022 and seemingly overnight, the SaaS world entered a new market cycle characterized by frugality and a pivot towards efficiency and specialization.

The fastest way to efficiency? Hiring freezes and layoffs.

Entry- to mid-level GTM roles – the “seat-license cohort” – were amongst the most affected. After years of predictions for continued SaaS TAM growth, the seats are going away and a return to rigor is turning down the music.

This Human Capitalist dives into the data on disappearing seats and includes contributions from top SaaS operators and investors on the future of GTM SaaS, including:

Why SaaS pricing models will change

Why GTM tactics have to change

Why only the strong will survive

Explore the data and industry leaders’ thoughts on disappearing seats below. Plus, as always, read to the bottom for three quick hits of the best human capital insights and the opportunity to submit your human capital questions.

SaaS-squashed?

In the 2023 edition of Scott Brinker’s MarTech Landscape, he highlighted 11,000+ barely differentiated offerings – the majority sold via seat licenses to GTM teams.

What a difference a year makes…

The last 12 months of job change data shows a collapse in the TAM for SaaS seat licenses. And, there are no signs suggesting the market is coming back.

What does this mean for seat-based pricing?

"The winner in the sales tech race will be the company that figures out how to break away from seat-based pricing and cracks usage-based pricing.

Today, there are millions of sales reps (SDRs, AEs, CSMs/AMs).

My prediction: this number will shrink over the next few years (let’s say, five years)."

– Brendan Short, CEO at Groundswell and LP at GTMFund | TheSignal.club

The reality is that Brendan’s prediction isn’t going to play out “over the next few years”… it is playing out in real-time.

“We are going through the end of the traditional SaaS seat-based pricing models. Post-COVID, companies bought more seats than they needed and are now busy cutting back. These seats are not coming back given how bloated the SaaS bills have become. The future belongs to consumption-based models or freemium models priced on premium features.”

– Santosh Sharan, COO at Retention.com

Regardless of the pricing model, all vendors face mounting pressure to deliver clear value as investors now crave a path to profitability more so than market share.

The new era of SaaS Darwinism will force companies to provide more value to their customers — a feat that most will achieve by building or buying more features.

“Today's businesses are trimming headcount and automating positions wherever possible. They're getting leaner, meaner, and smarter – this trend of getting fit will continue into the future. For SaaS providers, creating compelling ROI will be front and center. Tools that quantifiably drive ROI will retain pricing power. You are either irreplaceable or replaceable… there is no in-between.”

– Michael Moe, Founder & CEO at Global Silicon Valley | Dash Media

For those looking for leading indicators on which companies are going to become irreplaceable, job change data highlights the companies making investments in talent who can build “winner take all” products.

How will SaaS GTM tactics evolve?

SaaS GTM has been forced to change over the past 12-18 months. Decade-old outbound tactics are giving way to more sophisticated approaches that leverage data, signals, triggers, relevance, and context to better connect with potential customers.

Leading companies will double down on retention, ensuring the satisfaction of their existing customer base. Sales pros will continue to transition to thought leaders and trusted advisors — building engaged communities and demonstrating value well before any sales pitch.

“Sales and marketing ‘seats’ are disappearing, meaning fewer upsell opportunities and declining net dollar retention (NDR) rates for businesses with seat-based pricing.

The solution lies in more creative, hybrid pricing models where monetization connects to product usage as well as the outcomes generated from this product usage. GTM motions will then need to adapt accordingly with lower upfront commitments, a true company-wide dedication to customer outcomes and a broader application of product-led growth aimed at customer retention/expansion.”

– Kyle Poyar, Operating Partner at OpenView | Growth Unhinged

What happens when the music stops?

The SaaS market is saturated and the number of buyers and users is shrinking. Everybody who needs a SaaS tool already has one. Everybody who has a SaaS tool (or two, or five, or twelve) is looking to get more for less.

The SaaS landscape is shifting from “all you can eat” to “eat what you kill”.

For companies with growth models reliant on selling more seats… good luck. As seats disappear, companies are going to need to solidify exactly how they are better than their competitors and exactly how they plan to displace them.

Three quick hits

1) Is it all a D.R.E.A.M.?

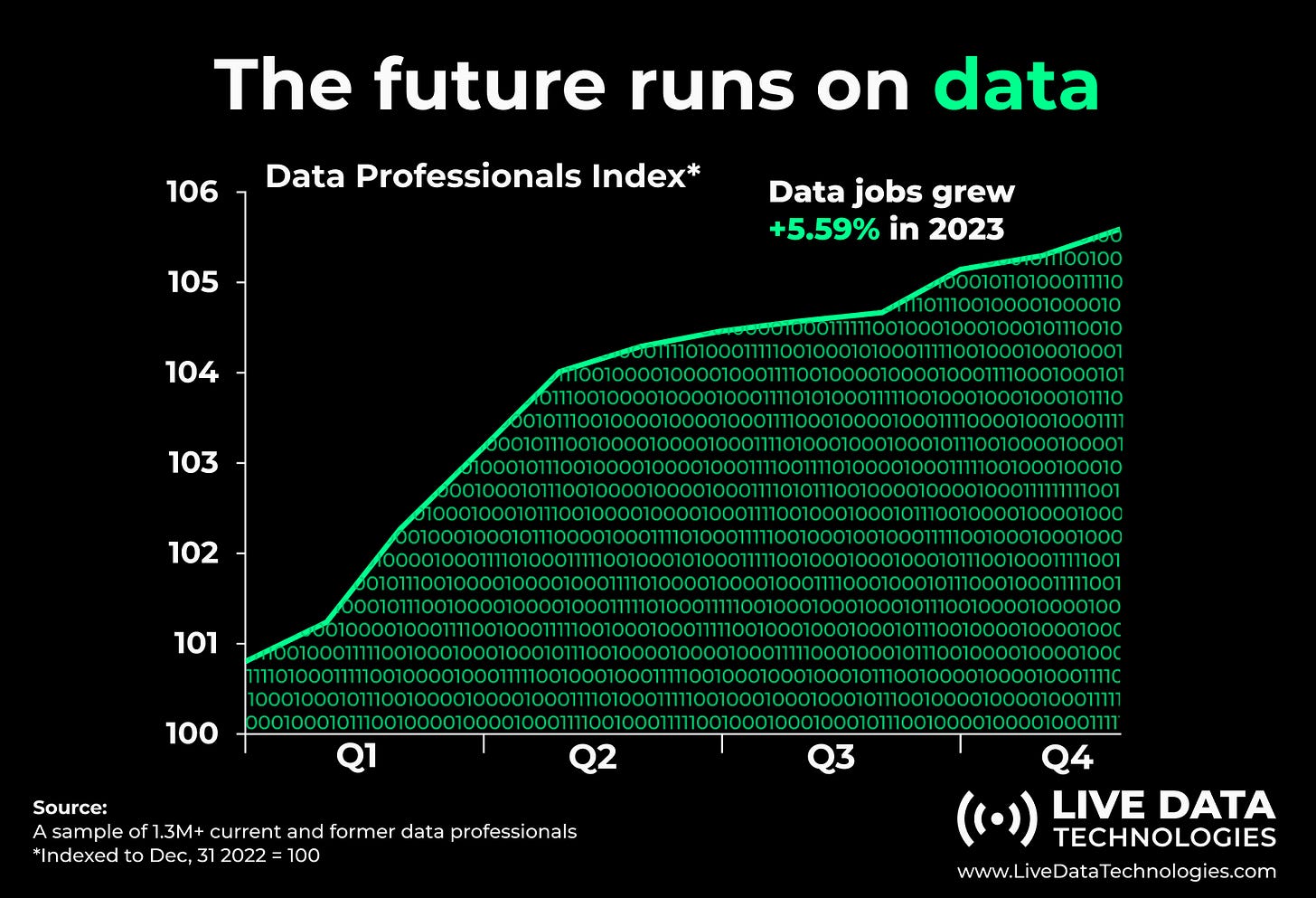

Nearly every business and business function is becoming more data-driven and data-centric. Across multiple business functions, data jobs grew 5.59% in 2023.

With all due respect to the Wu… Data Rules Everything Around Me.

Read more about the growth of data jobs here.

2) Is fractional work the future of work?

Fractional work has been growing in popularity for years. In 2023, thousands of professionals went from “in-house” to “gun-for-hire”.

Read more about how fractions are starting to add up here.

3) Will you quit or be laid off?

Following The Great Termination, job change data from Q4 2023 suggests that workers have renewed confidence in their ability to choose their employment fate.

Explore the data on voluntary versus involuntary job changes here.

What questions would you ask?

To put context around the “big numbers” of real-time human capital and job change data — specifically, 30k+ daily changes across 90M+ people at 4M+ companies — I started asking questions of our data.

For every question, there are answers, insights, and… more questions.

I’m constantly thinking about the next batch of questions and insights to dig into. If there is a human capital data question you’re interested in exploring, leave a comment below or reach out directly via LinkedIn.

https://www.theinformation.com/articles/pro-weekly-software-budgets-rising

Even with the "disappearing seats" SaaS users are projecting budgets rising.

Something does not add up.